HillCo Partners closely monitors and compiles information concerning the current economic climate/trends of the state. These factors, including Texas’ bond rating, are aspects that create an overall picture of the state’s general economic health. The following information has been compiled in order to create a more complete snapshot of the current economic status of Texas.

Labor Market Information

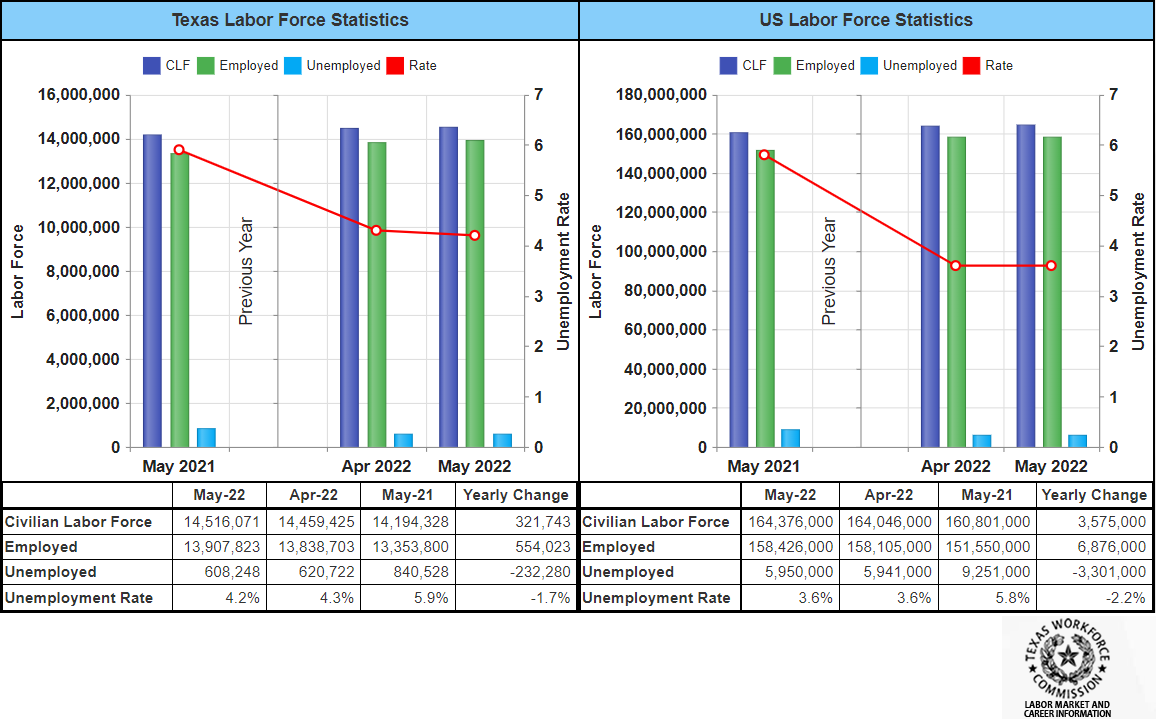

The most recent labor market information for the state is from May 2022:

May 2022 Texas LMI (Texas Workforce Commission):

- Unemployment Rate: 4.2%

- Total Non-Farm Employment: 13,357,100

- Jobs Change Over the Year: 762,400

- Annual Growth Rate: 6.1%

In comparison to April 2022, the unemployment rate has dropped by 0.1% and compared to UI rates a year ago it has decreased by 1.7%. Texas has added 74,200 nonagricultural jobs in May 2022 and total nonfarm jobs reached 13,357,100. In May, Leisure and Hospitality gained 13,500 jobs over the month. Since May 2021, the state has added 762,400 jobs. The largest growing fields over the month are Leisure and Hospitality gaining 27,600 jobs and Professional Business Services added 15,300 jobs. The Amarillo and Austin-Round Rock Metropolitan Statistical Areas recorded May’s lowest unemployment rates with a non-seasonally adjusted rate of 2.7% (Texas Workforce Commission).

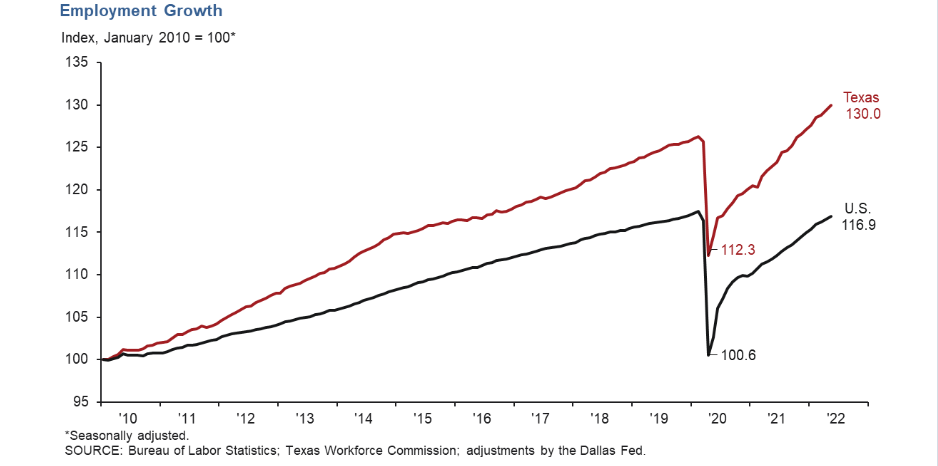

Texas Employment

According to the Federal Reserve Bank of Dallas, Texas employment expanded by 6.2% in April after growing by 5.2% in April. Job gains in most major sectors accelerated while construction posted the fastest employment. The Dallas Fed’s Texas Employment Forecast predicts 3.7% job growth this year.

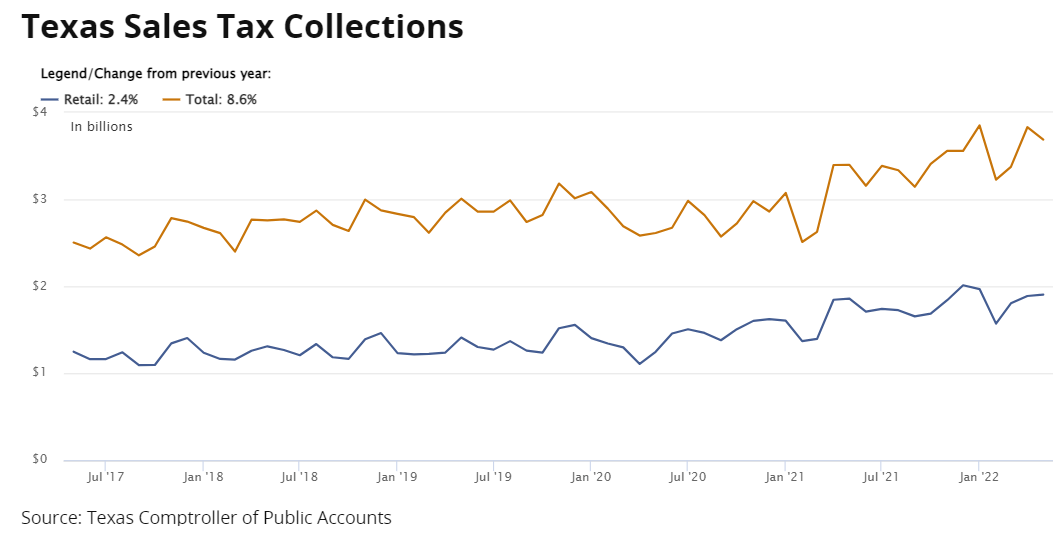

State Sales Tax Revenue

The Texas Comptroller is the states’ chief tax collector, accountant, revenue estimator and the agency is responsible for keeping the books for the multi-billion-dollar business of state government. Additionally, the Comptroller monitors economic data around the state monthly and publishes regular periodicals. Every month, Texas Comptroller Glenn Hegar releases information on state sales tax revenue. Comptroller Hegar announced at the beginning of June that state sales tax revenue totaled $3.7 billion in May, 8.6% more than in May 2021. The majority of May sales tax revenue is based on sales made in April and remitted to the agency in May. Comptroller Hegar noted that in May state sales tax collections reached double digit growth which was driven primarily by business spending and receipts from the oil and gas mining sector exhibiting “robust growth” compared to levels a year ago. Receipts from construction and wholesale trade sectors also showed strong growth. Spending in sectors that were largely impacted by the pandemic showed substantial gains including sporting events, concerts, and restaurants. Concerning this, Hegar said “[i]ncreases in these consumer-driven sectors, coupled with a decrease in receipts from the furniture and general merchandise sectors compared to a year ago, may further indicate that sectors that benefited from pandemic spending patterns will face continued headwinds due to a shift in consumer spending patterns from goods to services.” Fiscal 2022 franchise tax collections totaled $5.16 billion year-to-date through May (Texas Comptroller).

Major rating agencies, Moody’s, Fitch and Standard & Poor’s (S&P), issue ratings that characterize the state’s ability to repay debt. These agencies provide investors with assessments of the trustworthiness of potential investments in the state and possible risks involved. Additionally, highly rated borrowers typically pay lower interest costs. As of August 2021, Texas is top rated by all three of these agencies.

Texas’ Ratings (Texas Bond Review Board)

Fitch: AAA

Moody’s: Aaa

S&P: AAA