Link to report: https://www.ferc.gov/media/february-2021-cold-weather-outages-texas-and-south-central-united-states-ferc-nerc-and

From Appendix B:

Summary:

The Federal Energy Regulatory Commission (FERC) and North American Electric Reliability Corporation (NERC) performed its own study of the February winter storm, and this report is the most comprehensive of any report to date. Included as part of the analysis are previous summaries and reports on the event including the UT study that was released weeks ago. In addition to the performance of ERCOT, this report also discusses the performance of the SPP and MISO power regions.

In short, several recommendations (p. 18, detailed recommendations begin p. 183 and run for 57 pages) were issued and improvements in processes were identified.

Although 96% of generators submitted confirmation of having completed weatherization for the winter, a lack of follow-up or enforcement capability by PUCT was among the identified gaps for ensuring winterization by power generators (to which the PUCT has already implemented more rigid standards, inspections, and penalties for shortcomings). Forecasting of power availability and total potential load (demand) are also areas that require improvement, including a more dire worst-case scenario for loss of generation. Fuel supply challenges were discussed in detail and pointed to improvements needed for gas infrastructure. Note that many of these improvements have been underway for months at the prompting of the Texas Legislature and PUCT.

Highlights:

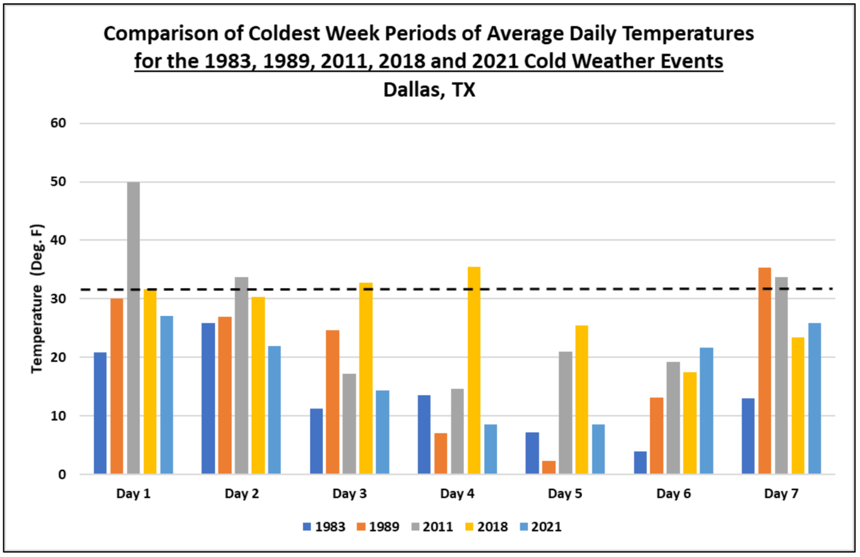

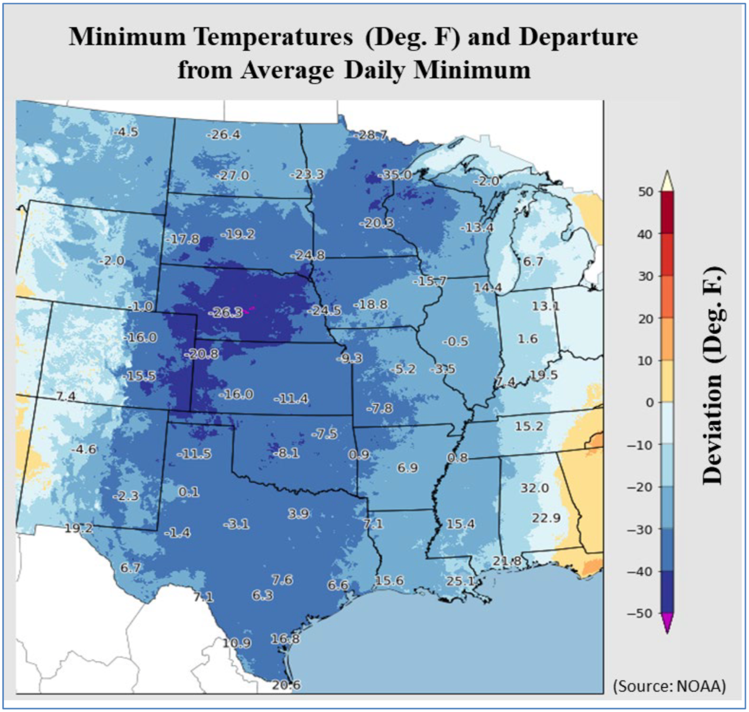

- The temperature graphic below shows that the ERCOT region experienced the worst of the cold, with MISO and all of the El Paso (WECC) region having less extreme temperatures as compared to normal winter weather. The SPP region (panhandle and northeastern Texas) was hit as hard as ERCOT.

- All power regions experienced outages and faced challenges related to the storms. Both SPP and MISO regions extend north across multiple states, and many of the power generation units in those states are equipped to deal with cold. Many are enclosed in structures for this reason. Enclosing facilities in Texas reportedly can cause overheating due to summer temperatures.

- 31% of outages across the state were caused by fuel issues, most of which relates to loss of natural gas (87% of the 31%) due to wellhead freezes, pipeline freezes, loss of power to wells or pipes, or processing plant issues (necessary to deliver pipeline-quality gas to customers).

- ERCOT’s lack of interconnection with surrounding power regions was noted.

- Natural gas contracting may become a focus of PUCT’s reliability measures. Page 42, footnote 81 (emphasis added): “Forty-two percent reported that they have access to firm transportation and/or dual fuels, 39 percent reported a mix of firm and interruptible transportation, and 10 percent reported interruptible gas supply only.”

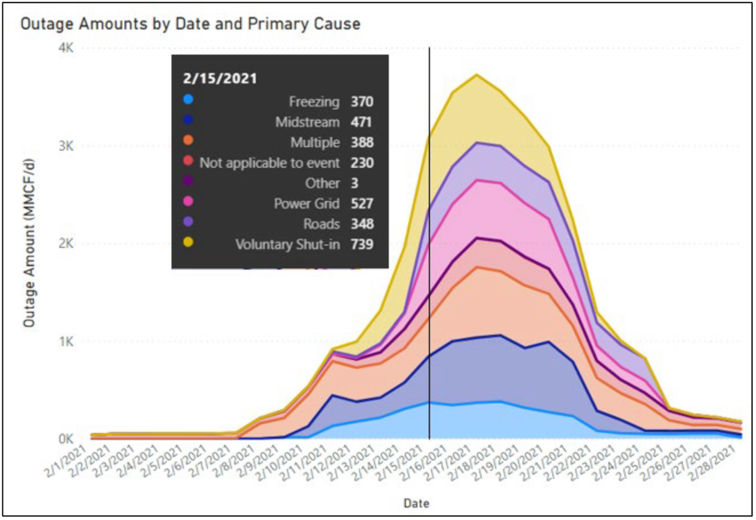

- Gas supply challenges are identified by cause in the chart that follows. These categories are somewhat vague. The report offers some details around each (e.g., “Voluntary shut-in” was rationalized due to safety, environmental risk, well protection, quick startup after the event, or allocation of resources to more productive wells).

- Page 67: “ERCOT received an email from Atmos-Pipeline Texas on February 10, stating that beginning February 12, there would be Level 4 restrictions on gas supply, meaning that generating units supplied by Atmos would be cut off completely.” The number of power generation units impacted by this early notice was not mentioned, but this would be problematic for ERCOT at the outset.

- Pipelines, both interstate and intrastate, indicated that they experienced extremely limited issues during the storm. The report also says that pipelines relied on natural gas compressors instead of electric compressors for pipeline flows, limiting exposure to electrical outages. This information is contrary to the direction that was being taken over the last three decades to move pipelines to electric compression to reduce emissions. More information needs to be gathered to understand how many electric compressors are in use today.

- Gas storage withdrawals reached record levels in Texas during the week, and national withdrawals were the second largest on record.

- Page 133 – The touch-and-go nature of ERCOT operations on February 15th are described over the next several pages. The erratic and unpredictable loss of power plants over the next few hours tested ERCOT operators, and the system was operated on a razor’s edge for an hour or more. ERCOT management and PUCT are choosing between maintaining grid stability and cutting off power to some Texans during life-threatening cold weather, a difficult choice at best.

- Page 166 – “Despite multiple recommendations since 2011 that generating units should take actions to prepare for the winter (including detailed recommendations for winterization plans),237 49 generating units in SPP (15 percent), 26 in ERCOT (7 percent), and 3 units in MISO South (4 percent), did not prepare any winterization plans. As further evidence that generating units could be better prepared for winter, 81 percent of the generating unit outages, derates or failures to start occurred at temperatures above the unit’s ambient design temperature.”

- Page 171: “Over 40 percent of the GOs/GOPs in the south central U.S. regions where “freezing issues” were identified as the predominant cause of unplanned generation outages, derates or failures to start (ERCOT and MISO South) stated that they did not incorporate specific generator-related recommendations from the 2011 Report or specific recommendations from the [NERC’s Reliability] Guideline.”

- Page 173: “Although having firm supply or transportation contracts did not guarantee a generating unit remained online, only 29 percent (109 units) of the natural gas-fired generating units with unplanned outages had both firm natural gas supply and firm natural gas pipeline transportation contracts.”

- Page 175: “For the Event overall, loss of power supply to natural gas infrastructure caused 23.5 percent of the decline in natural gas production.” FERC acknowledges this calculation was challenging for several reasons, including gas infrastructure loads did not submit critical load forms to utilities.