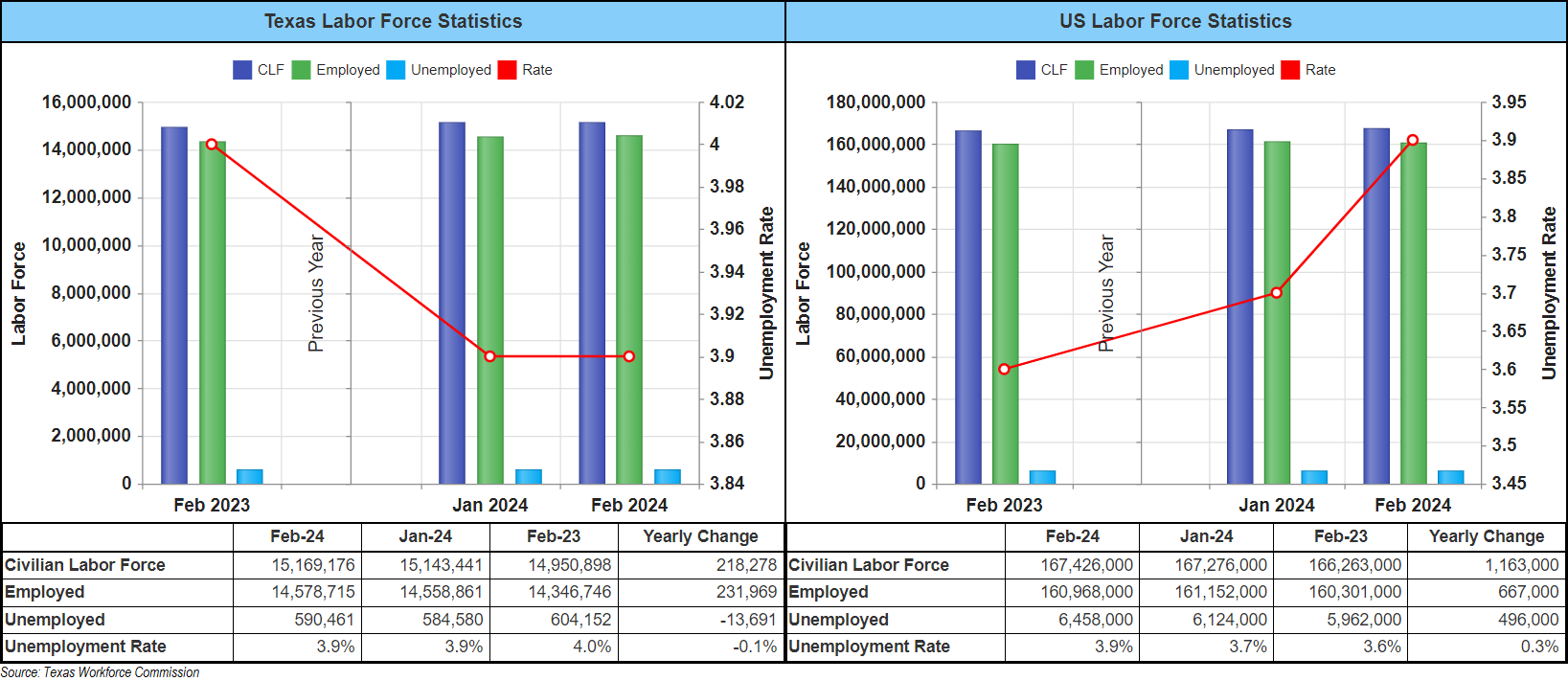

The following information has been compiled in order to create a more complete snapshot of the current economic status of Texas. The most recent labor market information for the state is from February 2024.

February 2024 Labor Market Information

- Unemployment Rate: 3.9%

- Total Non-Farm Employment: 14,103,700

- Jobs Change Over the Year: 291,400

- Annual Growth Rate: 2.1%

According to the Texas Workforce Commission, Texas’ seasonally adjusted job count increased by 49,800 over the month of February to reach 14,103,700 jobs. This reflects job growth in 44 of the last 46 months and marks the largest total nonfarm monthly job gain since January 2023. Texas’ total nonfarm employment grew by 291,400 jobs from February 2023 to February 2024, amounting to a 2.1% annual growth rate and outpacing the U.S. growth rate by 0.3%.

State Sales Tax Revenue Totaled $3.7 Billion in February

Texas Comptroller Glenn Hegar said state sales tax revenue totaled $3.69 billion in February, .05% more than in February 2023. “Among sectors primarily driven by business spending, remittances from the construction sector continued to grow, while receipts from the manufacturing and wholesale trade sectors were both down from February last year. Receipts from the oil and gas mining sector were modestly up compared with a year ago” Hegar said.

Texas collected the following revenue from other major taxes:

- motor vehicle sales and rental taxes – $586 million, up 8 percent from February 2023;

- motor fuel taxes – $302 million, down 1 percent from February 2023;

- oil production tax – $458 million, down 7 percent from February 2023;

- natural gas production tax – $186 million, down 39 percent from February 2023;

- hotel occupancy tax – $58 million, up 38 percent from February 2023; and

- alcoholic beverage taxes – $128 million, down 1 percent from February 2023.

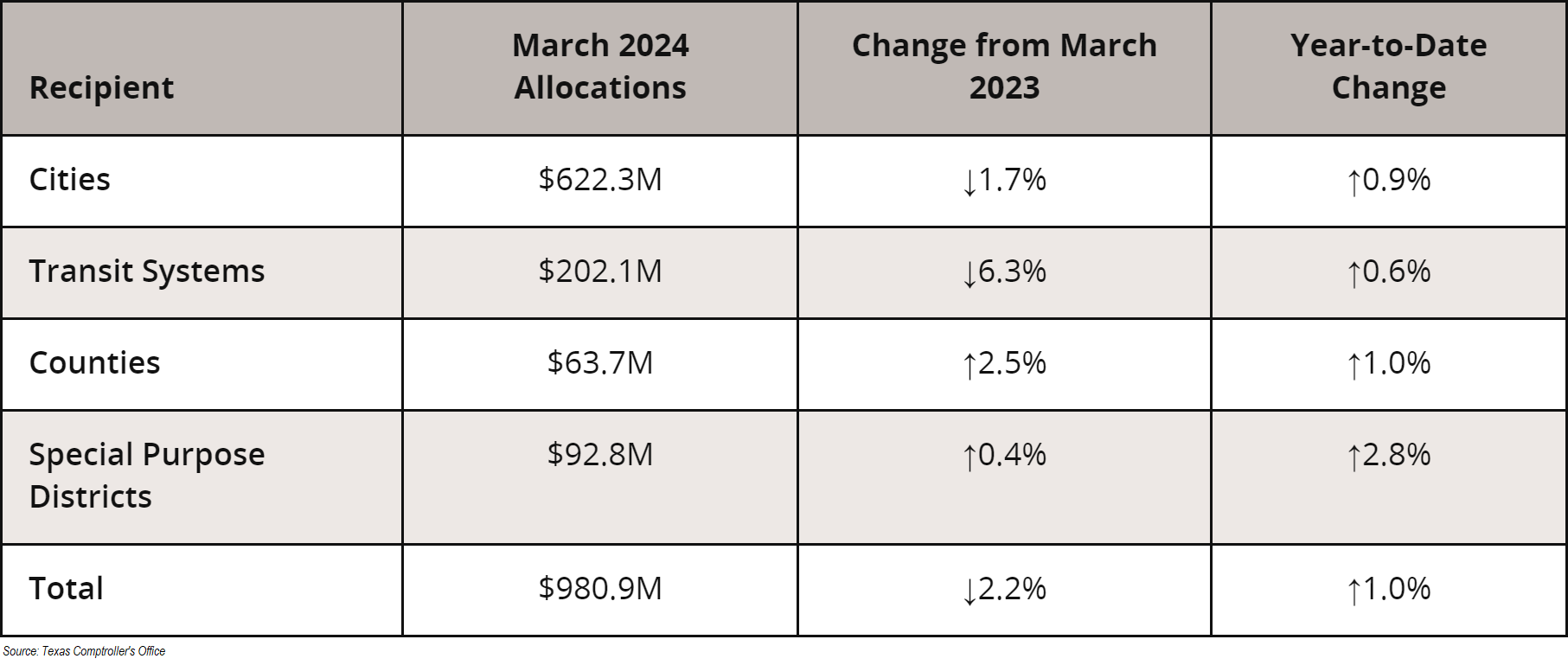

Comptroller Distributes $981 million in Monthly Sales Tax Revenue to Local Governments

Comptroller Glenn Hegar announced he will send cities, counties, transit systems and special purpose districts $980.9 million in local sales tax allocations for March, 2.2 percent less than in March 2023. These allocations are based on sales made in January by businesses that report tax monthly. More details on March sales tax allocations to individual cities, counties transit systems and special purpose districts can be found here.