Today both the House (HB 1) and Senate (SB 1) base budget bills have been filed and published on the Legislative Budget Board website. The base budget is a starting point in discussions as both chambers begin to discuss and work on the state’s funding priorities for the next two years.

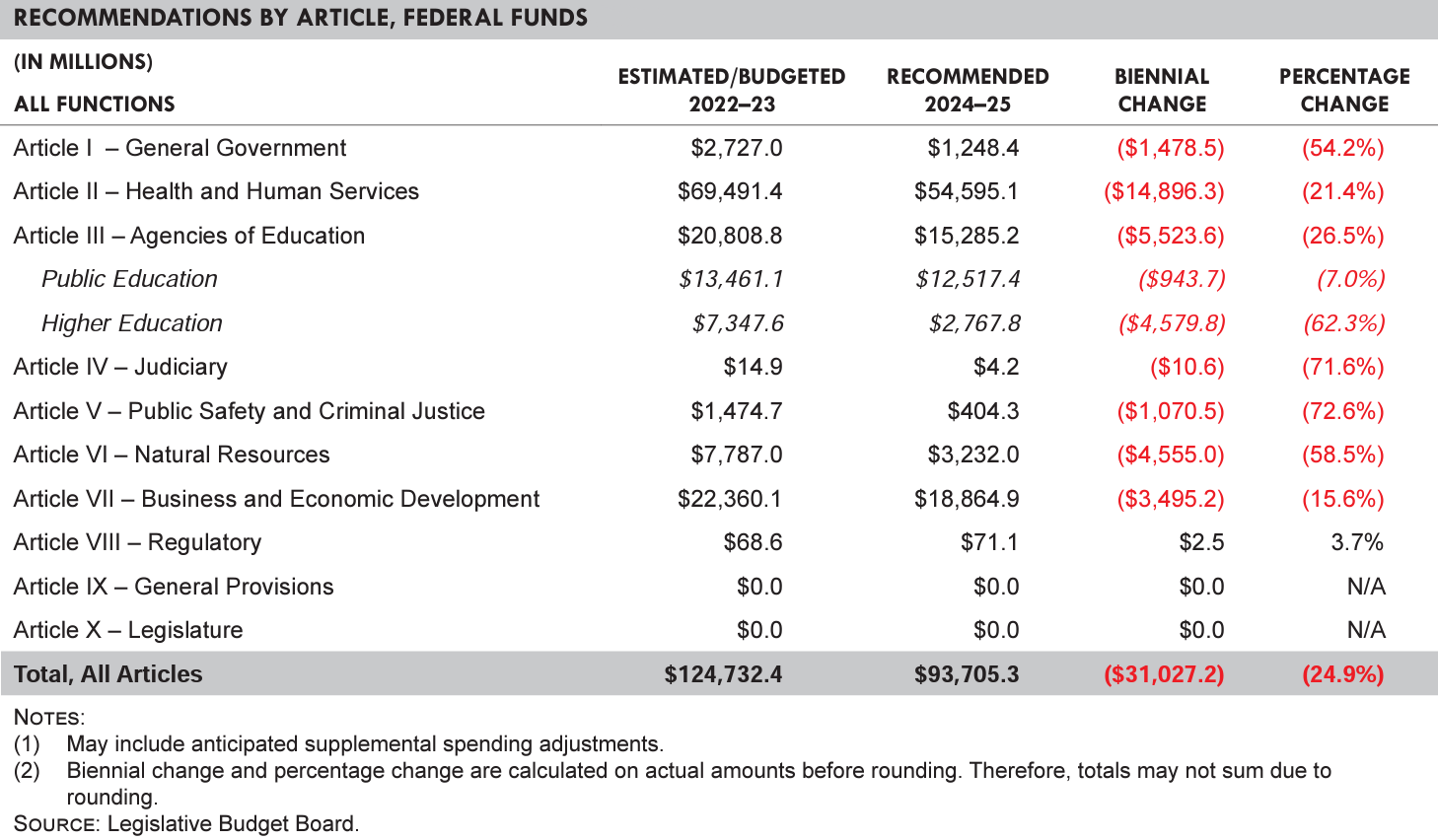

The budget bills have several similarities including both budget bills as filed projected estimated and budgeted amounts for the 2022–23 biennium are estimated to increase by approximately $32.4 billion in All Funds. This amount consists of a decrease of $974.1 million in General Revenue Funds, and a net increase of $33.4 billion in other funding sources (i.e., General Revenue–Dedicated Funds, Federal Funds, and Other Funds). The most significant non-General Revenue Funds increase occurs in Federal Funds ($26.2 billion) and mainly consists of increases for the Health and Human Services Commission for Medicaid ($12.5 billion), the Department of State Health Services for response to the COVID-19 pandemic ($3.7 billion), and the Teacher Retirement System of Texas for onetime funding for pandemic relief to help maintain TRS-Care and ActiveCare premiums ($0.7 billion). Other Funds increased by approximately $6.7 billion. Beginning September 1, 2015, the Texas State Comptroller established the Texas Economic Stabilization Investment Fund (TESTIF) to invest a portion of the ESF pursuant to this legislation. The Comptroller forecasts the 2024–25 biennial ending cash balance of the ESF plus the total asset value of the TESTIF to be $27.1 billion, reaching its constitutional maximum balance during fiscal year 2025. The 2024–25 biennial recommendations contain no appropriations from the fund.

Both bill summaries point out the Supplemental Appropriations recommended which are as follows:

- In addition to appropriations made in the General Appropriations Bill for the 2024–25 biennium, it is the intent of the Legislature to provide funding in fiscal year 2023 in a supplemental appropriations bill, from All Funds, for additional purposes including the following:

- Health and Human Services Commission: $2.3 billion for state hospital construction and additional inpatient capacity;

- Employees Retirement System of Texas (ERS): $1.0 billion for a onetime legacy payment to ERS;

- Texas Education Agency: $600.0 million to assist school districts in implementing school safety initiatives;

- Texas Facilities Commission: $400.0 million to be deposited into General Revenue–Dedicated Account No. 5166,

- Deferred Maintenance, to address future maintenance of state buildings, and $210.0 million for construction of a new records storage/archive facility for the Texas State Library and Archives Commission;

- Water Development Board: $400.0 million for flood mitigation;

- Texas Historical Commission: $300.0 million to be deposited in an endowment fund in the Safe Keeping Trust Fund for maintenance of historical sites contingent on enactment of legislation creating the fund, and $217.1 million for various restoration, maintenance, and improvement projects;

- cross-article: $273.6 million for vehicle replacement funding at state agencies;

- Fiscal Programs within the Comptroller of Public Accounts: $243.8 million to fully fund all remaining Texas Guaranteed Tuition Plan obligations;

- State Preservation Board: $200.0 million to be deposited in an endowment fund in the Safe Keeping Trust Fund for maintenance of state facilities contingent on enactment of legislation creating the fund;

- Parks and Wildlife Department: $100.0 million to fund park acquisition;

- salary increase: $148.9 million to fund three months in fiscal year 2023 of a 5.0 percent pay increase for classified state employees (or $250 per month, if greater); and

- Texas Public Finance Authority: sufficient funding to meet the obligations issued by the Texas Natural Gas

- Securitization Finance Corporation pursuant to House Bill 1520, Eighty-seventh Legislature, Regular Session, 2021, or similar legislation passed by the Eighty-eighth Legislature, 2023.

However, there are also differences in the bills and more details can be found by visiting the Legislative Budget Board website which has links to:

House

- 2024 – 2025 General Appropriations Bill – LBB Recommended: House (January 2023)

- Legislative Budget Estimates by Program Articles I, II, and III – Public Education Fiscal Years 2021 to 2025 (January 2023)

- Legislative Budget Estimates by Program Article III – Higher Education, Higher Education Group Insurance to General Academic Institutions Fiscal Years 2021 to 2025 (January 2023)

- Legislative Budget Estimates by Program Article III – Higher Education, Health Related Institutions to Special Provisions, and Articles IV and V Fiscal Years 2021 to 2025 (January 2023)

- Legislative Budget Estimates by Program Articles VI to X Fiscal Years 2021 to 2025 (January 2023)

- Legislative Budget Estimates by Strategy Articles I to III Fiscal Years 2021 to 2025 (January 2023)

- Legislative Budget Estimates by Strategy Articles IV to X Fiscal Years 2021 to 2025 (January 2023)

- Summary of Legislative Budget Estimates 2024-25 Biennium (January 2023)

Senate

- 2024 – 2025 General Appropriations Bill – LBB Recommended: Senate (January 2023)

- Legislative Budget Estimates by Program Articles I, II, and III – Public Education Fiscal Years 2021 to 2025 (January 2023)

- Legislative Budget Estimates by Program Article III – Higher Education, Higher Education Group Insurance to General Academic Institutions Fiscal Years 2021 – 2025 (January 2023)

- Legislative Budget Estimates by Program Article III – Higher Education, Health Related Institutions to Special Provisions, and Articles IV and V Fiscal Years 2021 to 2025 (January 2023)

- Legislative Budget Estimates by Program Articles VI to X Fiscal Years 2021 to 2025 (January 2023)

- Legislative Budget Estimates by Strategy Articles I to III Fiscal Years 2021 to 2025 (January 2023)

- Legislative Budget Estimates by Strategy Articles IV to X Fiscal Years 2021 to 2025 (January 2023)

- Summary of Legislative Budget Estimates 2024–25 Biennium (January 2023)