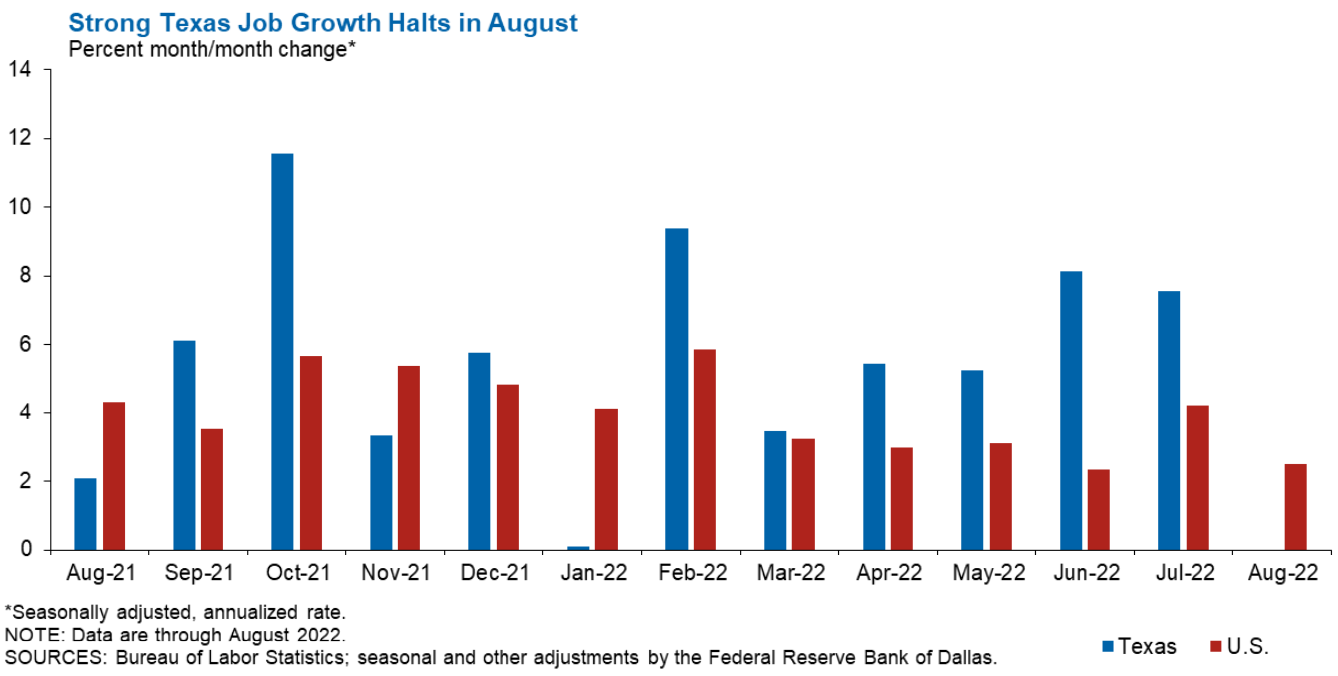

The Federal Reserve Bank of Dallas released an article noting that Texas could be headed for an economic slowdown. They note the most recent jobs report showed employment was flat in August while the unemployment rate rose from 4.0% to 4.1% and labor force/wage growth have also “eased.” The Dallas Fed’s Texas Business Outlook Surveys also point to “below-average” manufacturing production growth and service sector revenue. According to their markers, five out of eleven sectors in the state show declining employment, economic activity is trending down, and price pressures are easing from a record high. The article includes the table below that could indicate that labor markets are softening after growing 5.6% the first seven months of this year. With all of that being said, the Dallas Fed notes that their forecast predicts job growth will exceed 4% this year and in the remaining months could exceed the historical average of job growth.

Additionally in the last eight days the Dallas Fed has published the following economic articles that note a slowdown in economic activity:

- Dallas-Fort Worth Economic Indicators (9/28)

- Dallas–Fort Worth’s rapid economic growth slowed in August. Payrolls contracted, unemployment was unchanged and growth in the business-cycle indexes slowed.

- Texas Manufacturing Outlook Survey (9/26)

- Growth in Texas factory activity picked up in September, according to business executives responding to the Texas Manufacturing Outlook Survey.

- San Antonio Economic Indicators (9/23)

- The San Antonio economy slowed down in August. The business-cycle index expanded marginally as unemployment and wages stayed steady, and median rent increased. However, COVID-19 hospitalizations and employment declined.

- El Paso Economic Indicators (9/22)

- El Paso’s rapid economic growth slowed in August as the business-cycle index fell for the first time in almost two years and payrolls contracted across sectors.

- Texas Economic Indicators (9/21)

- The Texas economy slowed in August. Employment was flat, and unemployment ticked up. Growth in the Texas Business-Cycle Index softened but remained above the 2000–21 average.